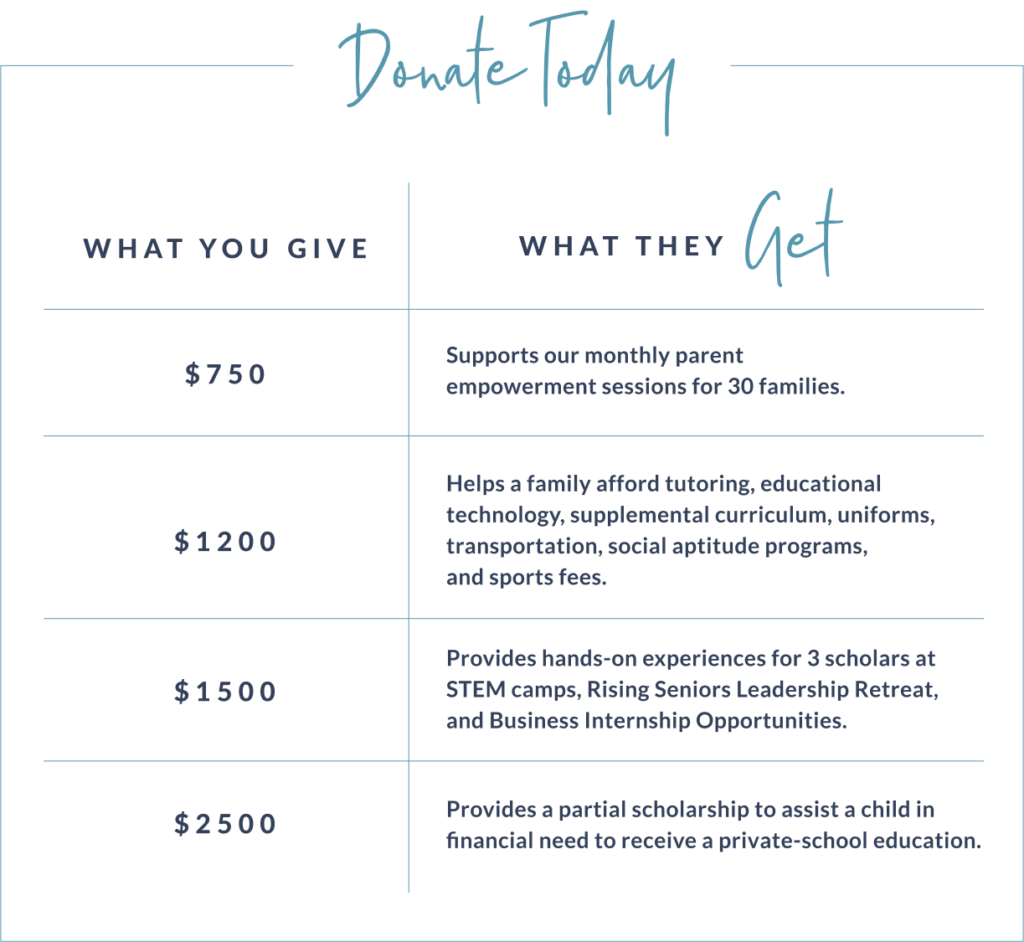

Looking to take the next step? Donate today and make a difference.

Your tax-deductible gift goes directly to the students and programs of Parents Challenge. For the past 23 years Parents Challenge has financially assisted nearly 4,000 students and their families. But there are many, many more students who need support. Can you help?

COLORADO CHILD CARE TAX CREDIT

The Colorado Child Care Tax Credit is a great way to maximize your donation. In order to promote giving to nonprofit organizations that provide quality child care in Colorado, the state has offered a special 50% income tax credit to taxpayers who donate to qualifying programs. The effect of this credit is that half of your donation is offset by a dollar-for-dollar reduction of your Colorado income taxes. In addition, if you itemize your federal income tax returns, you may be able to claim the credit and receive a deduction.

Making a monetary donation to Parents Challenge entitles you to this Colorado Child Care Contribution Credit! Combined with other state and federal itemized tax deductions, this is a great way to maximize your charitable giving. Anyone considering this credit should consult with their personal tax advisor to confirm the effects on their individual finances.

Cares Act for Charitable Giving

The CARES Act includes increased tax benefits for individuals and businesses who make charitable contributions in 2020.

Standard Deduction

If you plan to take the standard deduction (non-itemized) on your 2020 tax return, the CARES Act allows you to take an ‘above-the-line’ tax deduction of up to $300 for donations to charitable organizations. For reference, the 2020 standard deductions are: $12,400 for individuals and $24,800 for married couples filing jointly. Any donation to qualifying charities, up to $300, will be added to the standard rate of deduction. This deduction will continue into future tax years.

Itemized Deduction

If you plan to itemize your deductions on your 2020 tax return, the CARES ACT allows you to take a tax deduction, up to 100% of your Adjusted Gross Income (AGI), for contributions to qualifying charities. The CARES Act lifts the 60% of AGI limit for cash donations made in 2020.

Corporate Donations

For corporate donors, the CARES Act allows an entity to take a tax deduction of up to 25% of their Adjusted Tax Income for contributions to qualifying charities starting in 2020. The CARES Act lifts the 60% of AGI limit for cash donations made in 2020.

This information is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor.

PAYMENTS CAN ALSO BE SENT TO:

PARENTS CHALLENGE

2 N. Cascade Ave., Suite 1280

Colorado Springs, CO 80903

Through the parental advocacy sessions, I have learned; effectively advocating in parent/teacher conferences, community resources to broaden my kids’ opportunities and supplement their academic success, and how to better nurture their natural gifting, talents and interests. Through scholarships, I know others are standing with me, willing to invest in my children’s’ academic success and future. Through the student journal, it helps to write down specific goals, challenges and successes. This helps me to remember how much we are accomplishing through seemingly small successes, and it helps me understand the part I play in achieving bigger successes with my child and their school. I enjoy the encouragement I receive from Parents Challenge to keep advocating for my child. It helps to know that little investments along the way can pay huge dividends, in terms of encouraging my child to aim for academic and personal success. Gregory Family

Note: If you wish your entire donation to go to Parents Challenge as you make your contribution online,

you will be given an opportunity to pay the small percentage required for utilizing your credit card.

Easily transform everyday shopping.

Giving Assistant helps you save money while

supporting Parents Challenge.

Go to givingassistant.org